What Are Shareholder Agreements and Why Are They Important?

What Are Shareholder Agreements and Why Are They Important?

What Are Shareholder Agreements and Why Are They Important?

This is the same for the shareholders of a company.

If you have the chance to think through how you want to structure the company, what you want for the business, and the future in case unexpected events (like a death or disability) occur, and document those expectations, you create a situation where dispute is unlikely.

Documenting these expectations in some form (usually a shareholder agreement) is important because even if there is a dispute, you will still be able to use the terms of the shareholder agreement to resolve it with the least amount of time, effort and fuss.

Why Do You Need Shareholders Agreement?

Clients spend considerable time and money with us to resolve disputes about what they are each entitled and not entitled to, how to exit or remove someone from the company, and what will happen to those shares, IF no shareholder agreement was ever entered into.

When people stop agreeing and there is no effective mechanism to rely on to resolve the disagreement, they can be stuck in a deadlock that can only be resolved by a court.

A shareholder agreement can include a mechanism for dispute resolution that is quicker, easier and cheaper than court. Not to mention private.

Think about it.

If there are two shareholders who are also both directors (which is not an uncommon situation), then every decision about the company will have to be unanimous. It is rare for business partners to be on the same page 100% of the time, so situations will arise where the parties are deadlocked on a decision and there is no clear way forward.

A shareholder agreement can provide the way forward.

Without a shareholder agreement, court may be the only option.

Does it make sense to ‘save’ $5,000 now to lose $100,000, or your house, later?

What Is The Difference Between a Shareholder Agreement, Partnership Agreement, and Joint Venture Agreement?

There are many different types of business structures –

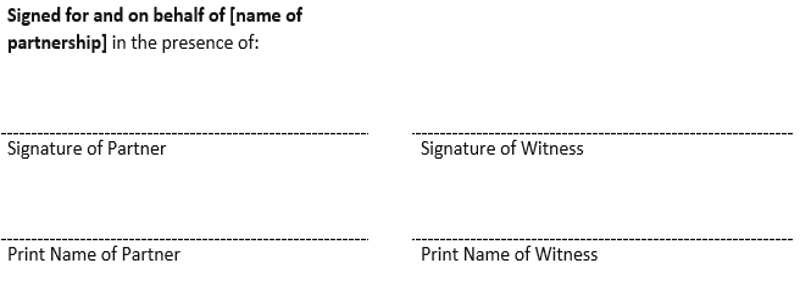

1. Partnership

If you are a sole trader and have decided to collaborate with another individual without setting up a company or trust, that formation is a partnership. Different sorts of entities can set up in partnership, but it tends to be most common between individuals, or their family trusts.

A partnership is not a separate legal entity, which means each partner is exposed to liabilities the partnership incurs. For example, if one partner commits fraud by stealing money from clients, whether the other partners know about it or not, the innocent partners may be required to repay the stolen money. The people who have suffered the loss don’t even have to pursue the defrauding partner first!

You would need a Partnership Agreement to clearly set out the rights and obligations of each partner, and how to exit or dissolve the partnership.

If you wish to pool resources and share expertise with another person or entity, that formation is a joint venture. A joint venture is very similar to a partnership. It may also not be a separate legal entity by itself, but it does not have the disadvantage of liability for the actions of the other parties.

You would need a Joint Venture Agreement to define each joint venture partner’s roles and responsibilities, and entitlements.

Sometimes, a successful joint venture can lead to incorporation, or be established as a company from the start.

3. Company

A company is an incorporated entity which is separate to the people behind it (shareholders and directors). The most common structure for a company is a proprietary limited company, which means each shareholder is only liable up to the amount unpaid on their shares.

Here is the typical structure of a company:

Company | |

| Title | Role |

| Shareholder | Owner |

| Director | Legal liability + strategy |

| Worker | Daily operations |

In a company, the director is legally responsible for the company and its strategic direction, the people who work in the business are responsible for daily operations, and the shareholders own the company.

Even with legal responsibility, there are some decisions a director or board of directors cannot make without approval of the shareholders. Some powers are reserved to the shareholders (eg. the power to replace directors) even though they rarely have any involvement in the day-to-day business activities.

It is important to understand what ‘hat’ you are wearing in a small business and try and focus on the responsibilities of that role only, rather than trying to be everything all of the time.

As an owner of the business, you should be interested in the finances and the risks the business is taking and feel confident the board has it managed.

As a director, you should feel confident you understand your legal liability, and that the company is operating within the kind of risk tolerance appropriate to your industry, and you have a plan for where the business is headed.

Workers need to get the jobs done.

As an aside –

What is the difference between a ‘board’ and a ‘director’ or ‘the directors’?

Nothing.

The ‘board’ is just the collective name for the directors working together. In a shareholder agreement, even if there is only one director at the time it is initially signed, the document will usually refer to the board, rather than a director alone to avoid having to make changes once another director is appointed.

Whether your company has a sole director or a board, they each are responsible for making the same decisions and all members are legally responsible for the company.

What Is In a Shareholder Agreement?

As with all business relationships, it is important for all parties to understand the proposed arrangement, their contributions, entitlements, and rights and responsibilities.

Essentially, a shareholder agreement is more specific than a constitution and can cover a broader range of topics such as:

- the business activity to be carried out

- what each shareholder owns

- whether, and if so, how new shareholders can become involved

- what rights shareholders have in appointing directors

- whether directors can act in the interests of their appointing shareholder

- dealing with shareholder loans

- outlining specific requirements for business operations, eg. business plans and budgets

- when distributions can be made

- how shares can be transferred

- valuing the company

- what happens if a director or shareholder exits

- what happens if a director or shareholder does something wrong

- rights if a buyer comes along

- what happens to assets and intellectual property if the company is wound up

- dispute resolution

How Do You Write a Shareholders Agreement?

A shareholder agreement needs to set out important matters relating to the shareholders including how they make decisions, their entitlement to dividends, and how they can exit the company or vary their interest in the company.

Other important factors include bad leaver provisions, restraint provisions and funding provisions.

Consider a scenario where you no longer wish to collaborate with the other shareholder (say, if they have acted recklessly or even fraudulently) and you want to either exit the company or remove the other person from the company, how do you do that? We have seen many situations where the lack of a Shareholders Agreement (or an effective mechanism within the Shareholders Agreement) caused stress and detriment to the shareholders as well as the company which may have to cease operations

Who writes a shareholder agreement?

We strongly recommend you go to a lawyer to help you draft your shareholders agreement.

This is a document that needs to be tailored to your situation and is not a standard form document like the company constitution which can usually be prepared by accountants when setting up the company.

Is a Shareholders Agreement a Contract?

Yes. It is a contract between the company and the shareholders, as well as between each shareholder.

It is possible, and common, to set different rights and obligations for each shareholder. For example, for a shareholder who has the knowledge and expertise to run the business or steer it in the right direction, it may be good for them to have the power to vote and make decisions for the company. On the other hand, if you have a shareholder who is an investor shareholder and purely contributes funds to the company, you may want to restrict their control over the company by giving them no voting power and only entitlement to dividends.

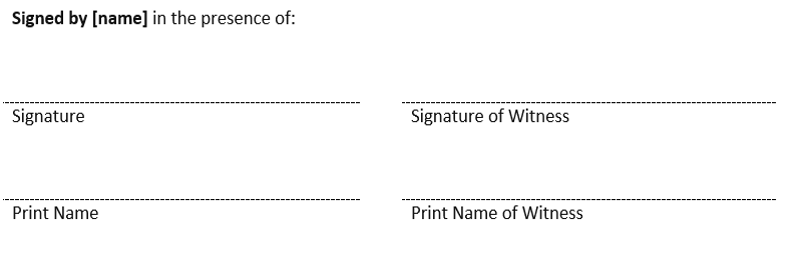

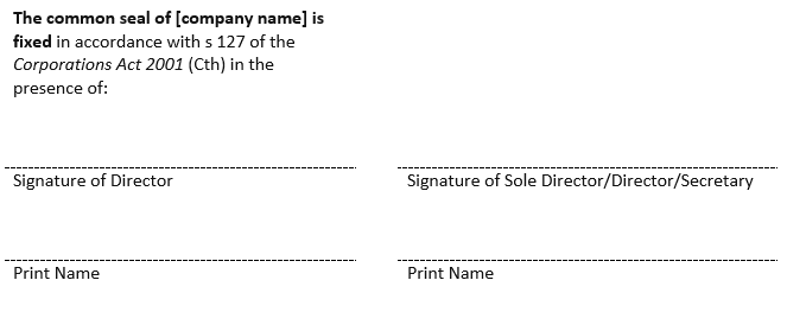

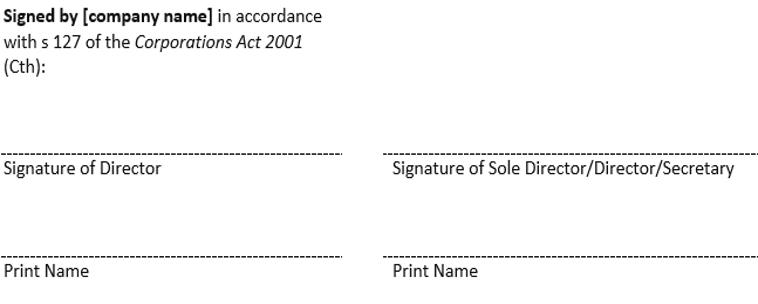

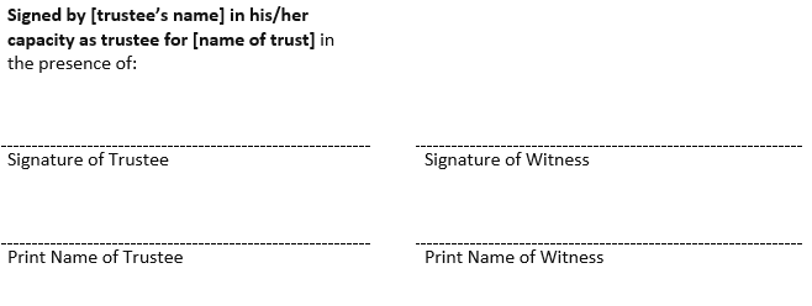

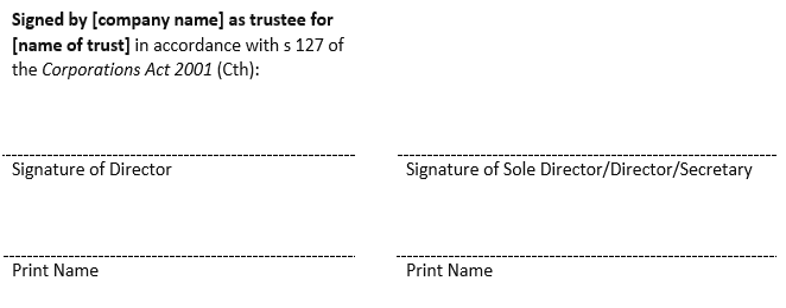

Does a Shareholder Agreement Need to be Signed?

Signatures are often the easiest way to prove that someone has had the opportunity to read and agree to the terms of a document.

Shareholder agreements can be signed, or a resolution (also in writing) passed unanimously by all shareholders at the time, can be passed to prove agreement and approval of the terms of the shareholder agreement. This requires a poll of shareholders.

Every shareholder, and the company, sign the shareholder agreement. If it is a resolution, then it is not passed without the unanimous approval of every shareholder.

Is a Shareholder Agreement Legally Binding?

Yes, provided that it is either signed by the company and each shareholder, or adopted by unanimous agreement of the shareholders by passing a resolution.

What Happens If You Don’t Have a Shareholder Agreement?

Your business could still operate smoothly in the absence of a shareholder agreement.

Case STUDY

Two builders set up business together on a handshake. They establish a company where they and their respective life partners are directors (4 people all together) and their respective family trusts are the shareholders. Each family trust holds 50% of the shares. The shareholders must vote on the appointment or removal of directors and a decision must be a majority decision. Because each family trust holds 50% of the shares, that means every decision has to be unanimous.

They each contribute equipment to the company.

They buy computers and motor vehicles through the company. The vehicles are expensive, under finance and registered in the name of the company, even though each builder takes one for their exclusive use and one builder puts personalised number plates on the vehicle they use.

A meeting with the company’s accountant highlights that there are unexplained transactions by one of the builders. The parties get into a dispute. As a result of the dispute, each of the life partners resign.

It takes 12 months for the builders to come to an agreement about the vehicles, equipment and jobs in the business. They cannot reach an agreement about the $300,000 + sitting in the business bank account, which was frozen by the bank pending their agreement.

To resolve the dispute, it is likely the parties will have to go to court, with the likely result that the company is wound up and the money in the bank is used to pay legal fees in getting to that decision.

If the parties had a written shareholder agreement, that dispute could have been resolved in a few short months, at a significantly lower cost.

However, not having a shareholder agreement would be problematic IF the shareholders cannot agree on a particular matter. It would be more difficult to resolve the dispute without a binding contract to rely on.

We strongly encourage you to put a Shareholders’ Agreement in place if you have not already done so, and have it regularly reviewed by a legal professional to ensure it remains up to date and compliant with regulatory requirements.

How can Onyx Legal help you?

If you have been in business with someone for a little while and everyone is still friends, or you are contemplating setting up a new company to run a business with someone new and would like to understand your legal risks, make an appointment with a member of our team.

Recent Comments